paying indiana state taxes late

You may request a filing extension but this does not push back the payment due date. For those who meet their sales tax compliance deadlines Indiana will offer a discount as well.

Irs Tax Refund Deadline What Are The Penalties If You Are Late Marca

The 2021 Indiana State Income Tax Return forms for Tax Year 2021 Jan.

. By law the IRS may assess penalties to taxpayers for both. What happens if you pay Indiana state taxes late. End Your IRS Tax Problems - Free.

This is equal to 5 of your unpaid tax bill up to a maximum of 25 per month. Including local taxes the indiana use tax can be as high as 0000. Information about novel coronavirus COVID-19 INgov.

The discount varies depending on the size of what was collected. Properties with unpaid 2020 property taxes that were due last year will be offered for sale. For current balance due on any individual or business tax liability you may call the automated information line at 317-233-4018 Monday through Saturday 7 am.

1 day agoThe Cook County tax sale begins next week on November 15. DORpay remains available to make single payments on tax bills due for the following tax types until July 8 2022. Including local taxes the indiana use tax can be as high as 0000.

Tax Penalties Failure to pay tax 10 of the unpaid tax liability or 5 whichever is greater. The state of Indiana requires you to pay taxes if youre a resident or nonresident who receives income from an Indiana source. April 15 is the annual deadline for most people to file their federal income tax return and pay any taxes they owe.

For those collecting less than. What is the penalty for paying Indiana state taxes late. The IRS can assess whats known as a failure-to-pay penalty if you dont pay your federal taxes.

This penalty is also. The state income tax rate is 323 and the sales. Indiana Department of Revenue.

Ad BBB Accredited A Rating. Tax Penalties Failure to pay tax 10 of the unpaid tax liability or 5 whichever is greater.

Indiana Automatic Taxpayer Refund Payments Start To Hit Bank Accounts

How We Got Here From There A Chronology Of Indiana Property Tax Laws

Filing Taxes Living In The U S Office Of International Services Indiana University

Best States For Low Taxes 50 States Ranked For Taxes 2019 Kiplinger

Dor What Happens If I Don T Pay My Indiana Income Taxes

Illinois Sales Tax Small Business Guide Truic

5 Mailing Or Delivery Service Tips For Paper Tax Return Filers Don T Mess With Taxes

Local News How To Avoid Late Tax Penalties 4 10 22 Brazil Times

Estimated Tax Payment Deadline Passed What Do I Do

How To Read Your Bill Aes Indiana

Business Income Taxes In Indiana Who Pays

2022 Average Irs And State Tax Refund And Processing Times Aving To Invest

![]()

Llc Indiana How To Start An Llc In Indiana Truic

State Of Indiana Quarterly Premium Tax Form Fill Out Sign Online Dochub

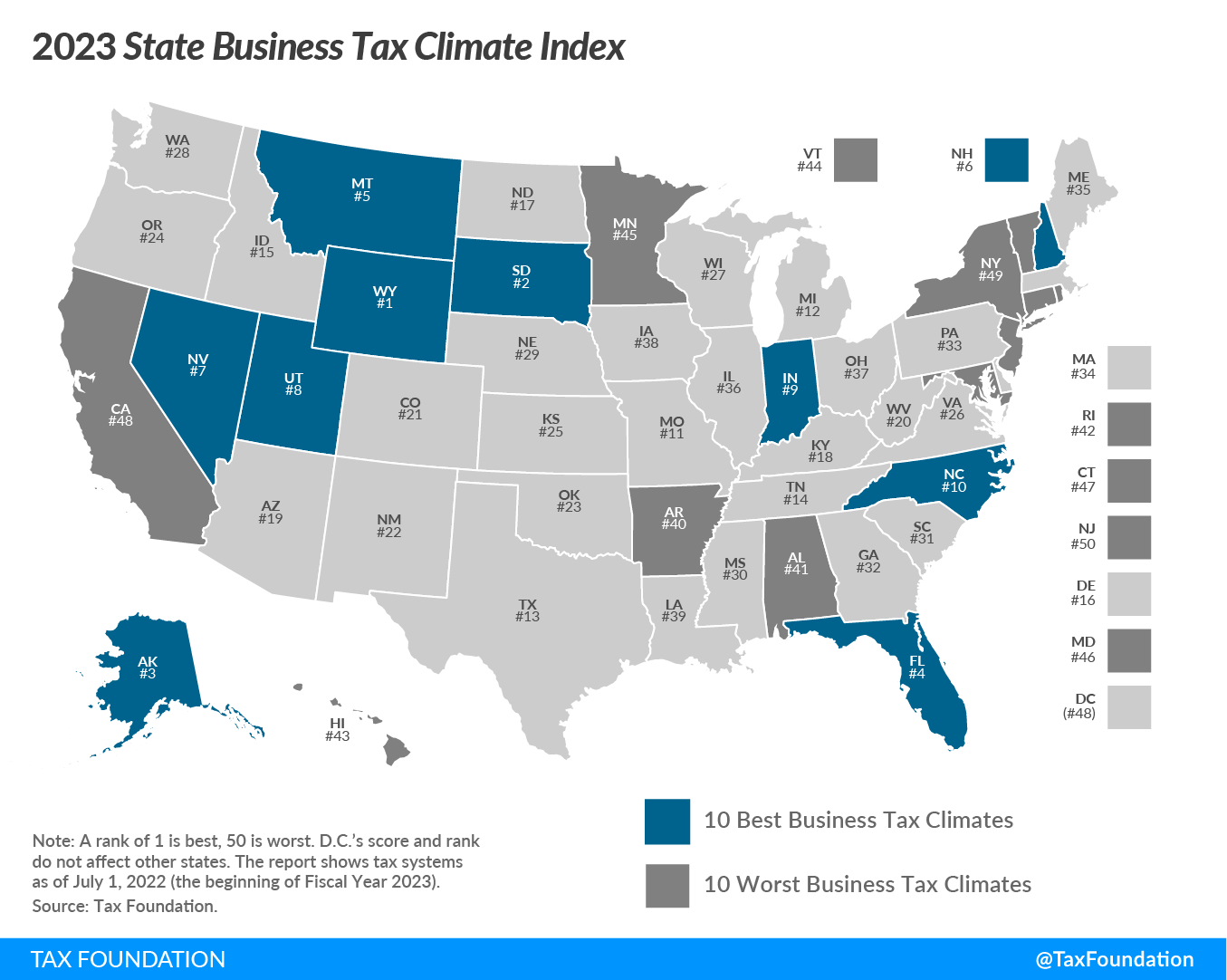

2023 State Business Tax Climate Index Tax Foundation

Current Payment Status Lake County Il

2022 State Tax Reform State Tax Relief Rebate Checks

Irs Tax Refunds Coming If You Paid Late Tax Filing Penalties Money